Stake KYC – Verification Process, Levels and Documents

Understand the Stake KYC process with all levels explained, required documents, verification timelines and tips to avoid delays for smooth account approval.

- Verification levels and their requirements

- Documents needed for fast approval

- Typical KYC timelines and status updates

- Benefits unlocked after completing verification

Written by Secod on 30-07-2025 — Updated on 06-01-2026

What Is Stake KYC

The Stake KYC process is a standard verification procedure used by the platform to confirm a player’s identity, age and location. By completing these checks, Stake ensures that its casino remains a safe and compliant environment, strengthening overall security and protecting both users and the platform.

Why KYC Matters For Players

Completing KYC helps protect your account and keep funds safe. It also ensures smoother withdrawals, prevents fraudulent activity and supports responsible gaming. For players, this adds an extra layer of security, guaranteeing that only the rightful owner has access to the account and its balance.

How Stake’s Risk-Based Process Works

Stake applies a risk-based process built on customer due diligence. This includes document checks, ongoing review and regular monitoring of activity. The goal is to detect unusual behavior early, confirm legitimate players and keep the platform secure while maintaining a fair and transparent gaming experience.

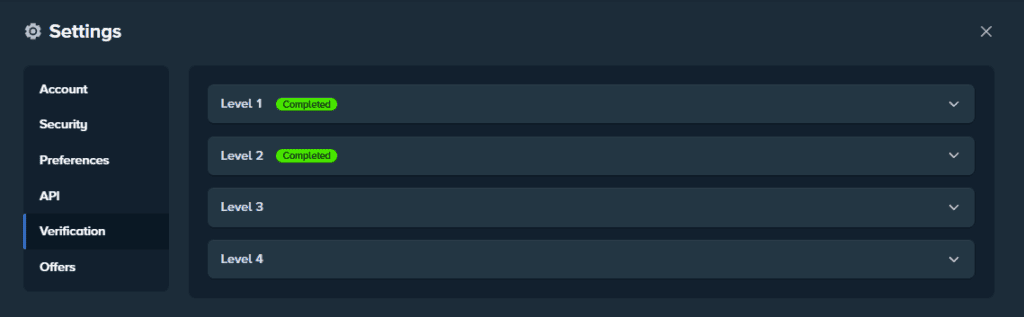

KYC Levels on Stake

The Stake KYC levels are structured in four steps. Each level gradually increases the requirements while unlocking more features for the player. This guide explains what each stage requests and how to complete the process smoothly.

Stake KYC Levels Overview

| Level | What Stake Asks | Documents Required | Image/Format Requirements | Typical Review Time | Access Unlocked |

| Level 1 | Basic profile details | Name, age, residential address, date of birth | Online form, text confirmation | Minutes | Entry access to casino |

| Level 2 | Government-issued ID | Passport, national ID or driver’s license | Colour scan/photo, all corners visible | Hours | Full deposit and withdrawal rights |

| Level 3 | Proof of address | Bank statement, utility bill, tenancy, tax letter | PDF or photo, under 6 months old | 1–2 days | Higher withdrawal limits |

| Level 4 | Source of funds | Salary slip, investments, inheritance, mining ledger | Recent and legible, issuer details | 2–5 days | Maximum account access & VIP eligibility |

Level 1 — Basic Profile Check

At Level 1, players confirm their identity by providing full name, residential address, date of birth and age. This creates a verified profile and ensures the casino account matches the user’s personal details before accessing deposits, withdrawals and bonuses.

Level 2 — Government-Issued ID

Level 2 requires a government-issued document such as a passport, national ID card or driver’s license. A colour scan or photo showing all four corners must be uploaded. This step strengthens identity verification and prevents fraudulent access to the player’s account.

Level 3 — Proof of Address

At Level 3, users must provide proof of address no older than six months. Accepted documents include a bank statement, utility bill, tenancy agreement or tax letter. This ensures that the address on file matches the account details for additional security.

Level 4 — Source of Funds

Level 4 verifies the source of wealth. Players may submit a salary slip, investment record, inheritance document, company sale contract or a crypto mining ledger. Documents must be recent and legible, proving that deposited funds come from legitimate sources.

Required Documents and Quality Standards

For smooth verification, Stake requires specific documents that meet clear quality standards. Each user must provide proof through government-issued and supporting files that are readable, recent and match account details. Submitting correct documents avoids delays and repeated requests.

Accepted vs Not Accepted Proof of Address

For proof of address, Stake accepts bank statements, utility bills, tenancy agreements and tax letters issued within the last six months. Documents like mobile phone bills, internet invoices or medical records are not accepted. Providing valid files ensures timely approval without rejection.

ID Image Guidelines for Fast Approval

When submitting a government-issued ID, ensure a colour scan or photo of both front and back. Images must clearly show all four corners, be glare-free and fully readable. Following these capture standards increases the chance of first-time approval, reducing the waiting period for account verification.

Source of Funds Examples and Notes

For source of funds, accepted documents include salary slips, share sales, inheritance records, company sale agreements or crypto mining ledgers. All files must be less than six months old and display the name, address, issuer and date. Clear details are vital to confirm funds’ legitimacy.

Document Checklist

| Document Type | Accepted Examples | Not Accepted | Must Show | Age Limit |

| ID (Government-Issued) | Passport, National ID, Driver’s License | Expired IDs, photocopies | Full name, DOB, photo, four corners | Valid & current |

| Proof of Address | Bank Statement, Utility Bill, Tenancy, Tax Letter | Mobile/internet bills, medical docs | Name, address, issuer, date | < 6 months old |

| Source of Funds | Salary slip, Investment sale, Inheritance, Crypto ledger | Unverified transfers, vague receipts | Name, issuer, clear transaction details | < 6 months old |

Timelines, Status and Re-Verification

The KYC verification process on Stake has different time windows depending on document complexity and queue size. Understanding your status helps manage the waiting period, while the support team may request re-verification when activity or limits change.

Typical Review Windows

Basic checks often complete in minutes or hours, while higher-level reviews can take several days depending on queue and priority. Submitting clear, valid documents shortens approval times and minimizes unnecessary delays during the KYC process.

Understanding Status in Your Account

Each Stake account shows a status such as pending, verified or action required. Pending means the team is reviewing, verified confirms approval and action required signals missing or unclear documents. Prompt responses keep the process moving smoothly.

When Stake May Request Updates

The platform may request an additional check when you increase activity or raise limits. Profile changes can also trigger a need to re-verify. Uploading updated, clear documents ensures continued access without interruptions in your account functions.

Verification Status and Next Steps

| Status | What It Means | What To Provide | Where To Upload | Expected Timing |

| Pending | Documents under review | None, unless requested | KYC dashboard | Minutes to days |

| Verified | KYC process completed successfully | — | — | Instant confirmation |

| Action Required | Issue found (blurry, mismatch, missing file) | Corrected documents | KYC dashboard | Within hours once fixed |

| Re-Verification | Triggered by new limits or profile activity | Updated proof (ID, address, funds) | KYC dashboard | Few days |

| Blocked | Temporary hold pending review or compliance | Contact support with full details | Support ticket/email | Case by case |

After Verification — Access and Limits

Completing KYC unlocks smoother account access, faster deposit and withdrawal processing and eligibility for certain bonuses. Verified players also enjoy higher limits, ensuring a secure and seamless experience across the casino platform.

Deposits and Withdrawals Run Smoother

Once your documents are verified, deposit and withdrawal transactions process more quickly and securely. Funds move efficiently between your Stake wallet and external addresses, reducing delays and ensuring every cash-out request is handled with confidence.

Eligibility for Selected Bonuses

Some Stake bonuses and rewards are available only to verified players. By completing KYC, you confirm your eligibility for promotions tied to the VIP program and other offers, ensuring you never miss rewards reserved for verified accounts.

Privacy and Data Security

Stake treats privacy and security as top priorities. All customer data and uploaded documents are handled through encrypted systems, ensuring the platform protects your information while meeting compliance requirements and safeguarding your account from fraudulent access.

How Stake Uses Your Information

Your documents are reviewed only for compliance with regulatory standards, fraud prevention and maintaining a secure environment. This process supports safe payments, validates withdrawals and keeps account integrity intact without sharing data beyond what’s required by laws and licensing authorities.

Tips to Keep Your Account Secure

Players should enable 2FA, choose a strong password and regularly update credentials to stay safe. These steps, combined with Stake’s built-in measures, ensure your account remains protected and resilient against unauthorized activity.

Avoiding Verification Issues

Proper preparation helps you pass verification without delays. By submitting clear documents and ensuring profile consistency, players can avoid common issues that slow down the review process and require extra submissions.

Common Upload Errors to Avoid

Frequent mistakes include blurry scans, cropped edges, mismatch between details and glare hiding important fields. To prevent rejection, always provide a high-quality, glare-free photo showing the full document with every corner visible.

Matching Names and Addresses

Always confirm that the name and address in your Stake account match exactly with the submitted document. Even small differences in spelling or formatting may trigger manual checks, extending review times unnecessarily.

When to Contact Support

If a review stalls, reach out to support with clear photos, proper file formats and timestamps. Providing full details helps the team resolve your questions quickly and deliver timely assistance for faster approval.

Other Stake Blog

Who Owns Stake in 2026?

July 30, 2025

![Pragmatic Play Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2024/08/pragmatic-play.webp)

![Hacksaw Gaming Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2024/08/hacksaw-gaming.webp)

![Nolimit City Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2024/08/nolimit-city.webp)

![Titan Gaming Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2025/01/Titan-Gaming-logo-black.webp)

![Popiplay Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2024/08/popiplay.webp)

![BGaming Review [current_year] – Online Casinos & Slot Games](https://bonustiime.com/wp-content/uploads/2024/08/BGaming.webp)